By looking at the net operating income, they can see how much money a property can generate after operating expenses and decide whether it's a good investment and what price they're willing to pay for it. They also use NOI to determine the initial value of a property. Real estate investors and creditors use NOI to determine whether a piece of property will be a good investment. To calculate net operating income, you subtract the operating expenses from the total gross income for the property. Related: Learn About Being a Property Manager 3. Once you have identified all the operating expenses, add them to determine the total cost of the property's operating expenses. When calculating all operating expenses, you don't include debt services like a mortgage payment or money owed to a private lender. Insurance: This can be a sizable cost that should be included in operational expenses.

Repairs: This should include everything from fixing broken air conditioning units to maintaining the landscaping. However, they're only included in your NOI calculation when you're not passing this expense along to the tenants. Utilities: These often include trash, water, internet and other utilities.

Define noi professional#

However, the expense of professional management can be offset by the savings of having a professional maintain the property and manage operations. Professional management: This can be a substantial expense that's normal for larger commercial properties. Marketing and advertising: These expenses can vary significantly, particularly when the property is being advertised to consumers versus when it's being used for a retail or office space. Once you have determined all the possible sources of income that a property generates each year, calculate the total gross income for the property. Retail income from storage facilities or moving supplies Income for a property includes more than just rental income. Here are the basic steps you can use to calculate NOI:

Define noi how to#

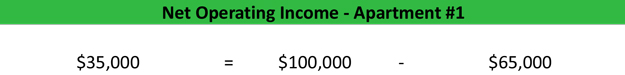

Net Pay: Definitions and Examples How to calculate net operating income Regardless, net operating income is a crucial aspect of evaluating the profitability of a property. Investors operate and manage assets differently, which is why it's not uncommon to have two NOIs, one based on actual performance and one based on the projected income and expenses. NOI equals all gross operating income minus any operating expenses. In other words, it measures the amount of cash flow a property has after all operating expenses have been paid.

Net operating income (NOI) is a probability formula used in real estate to measure the profitability of income-generating real estate investments. Related: Learn About Being a Real Estate Agent What is net operating income? In this article, we will discuss what a net operating income is, how you can calculate it and how it can be used. While NOI is a simple formula to calculate, identifying and calculating your total operating expenses and income-generating sources does take time. Because it excludes interest expenses, income tax costs and other non-operational expenses, it's a good indicator of your business's core performance without the effects of these other items. If you are interested in real estate investing or just want to gauge the profitability of your own business, the net operating income formula can be highly useful.

0 kommentar(er)

0 kommentar(er)